Introduction to Reevo Money

In today’s rapidly evolving digital economy, financial services are no longer limited to traditional banks and physical branches. The rise of fintech platforms has reshaped how individuals and businesses manage, move, and grow their money. Reevo Money emerges in this landscape as a modern digital finance concept focused on simplicity, speed, and accessibility.

What Is Reevo Money?

Reevo Money can be understood as a digital money ecosystem designed to help users manage financial transactions in an increasingly cashless world. Rather than focusing on brick-and-mortar banking, Reevo Money aligns with the idea of digital wallets, online transfers, and technology-driven financial tools.

At its core, Reevo Money emphasizes:

- Digital-first financial management

- User-friendly access to funds

- Secure and transparent transactions

- Borderless or low-friction money movement

Instead of replacing traditional finance entirely, Reevo Money fits into the broader fintech movement that complements and enhances existing financial habits.

The Philosophy Behind Reevo Money

Simplicity Over Complexity

One of the major problems in finance today is unnecessary complexity. Forms, long approval processes, and confusing interfaces discourage people from fully engaging with financial tools. Reevo Money’s philosophy centers on simplifying financial interactions, allowing users to focus on outcomes rather than processes.

Financial Inclusion

Reevo Money reflects the growing belief that everyone should have access to efficient financial tools, regardless of location or background. Digital finance platforms are often designed to lower entry barriers by minimizing paperwork and enabling mobile access.

Technology as an Enabler

Instead of seeing technology as a risk, Reevo Money treats it as an enabler of trust, speed, and scalability. Automation, encryption, and smart system design all contribute to a smoother financial experience.

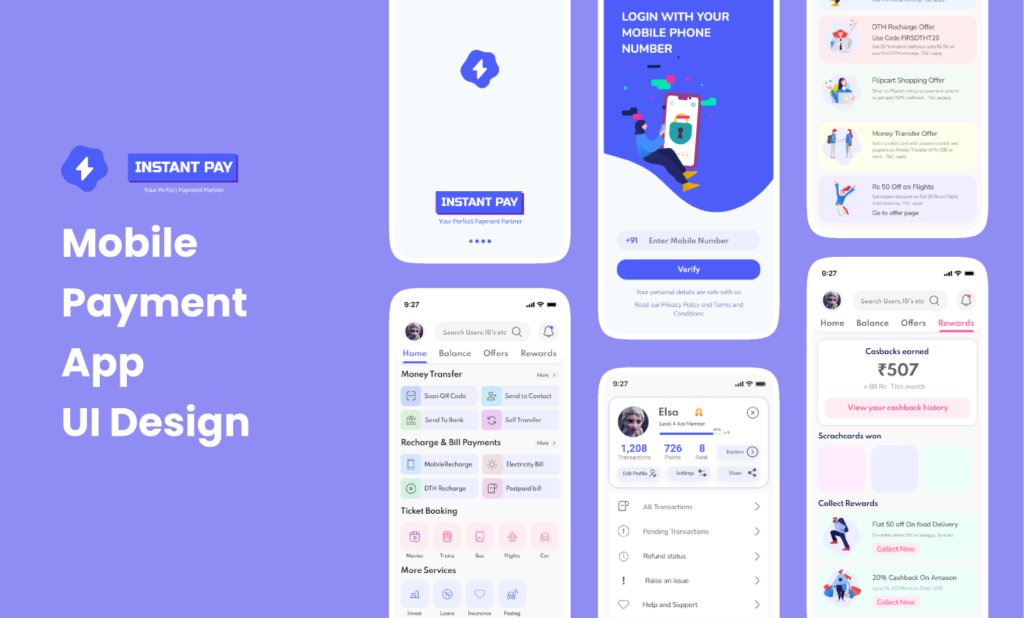

How Reevo Money Works (Conceptual Overview)

While implementations may vary, a Reevo Money–style system typically operates through several interconnected components:

1. Digital Wallet Infrastructure

Users interact with Reevo Money through a digital wallet. This wallet acts as a virtual container for funds, transaction history, and account settings.

Key features often include:

- Balance tracking in real time

- Secure login and authentication

- Transaction summaries and analytics

2. Money Transfers and Payments

Reevo Money focuses on fast and efficient transfers, whether between individuals or businesses. The goal is to reduce waiting times and transaction friction.

Transfers may support:

- Peer-to-peer payments

- Online purchases

- Service-based payments

3. Security and Verification Layers

Security is a cornerstone of any digital finance platform. Reevo Money emphasizes multi-layer protection through:

- Data encryption

- Identity verification processes

- Transaction monitoring

These measures help build user confidence and long-term trust.

4. Integration With Digital Commerce

Modern money systems do not operate in isolation. Reevo Money aligns with e-commerce, subscription services, and online marketplaces, making digital payments more seamless.

Key Features Associated With Reevo Money

User-Centered Design

A defining characteristic of Reevo Money is its focus on the user experience. Clean interfaces, intuitive navigation, and clear transaction flows reduce errors and improve satisfaction.

Speed and Availability

Traditional financial systems can be slow, especially across borders or outside business hours. Reevo Money prioritizes always-on access, enabling users to manage funds when they need to.

Transparency

Clear transaction records, visible fees (if any), and easy-to-understand summaries support better financial decision-making.

Scalability

As users’ needs grow—from personal use to business operations—Reevo Money is conceptually designed to scale alongside them.

Reevo Money in the Broader Fintech Ecosystem

Reevo Money does not exist in isolation. It fits within a global shift toward:

- Cashless societies

- Mobile-first financial behavior

- Decentralized and digital payment systems

Consumers increasingly expect financial tools to work as smoothly as messaging apps. Reevo Money reflects this expectation by prioritizing speed, clarity, and digital convenience.

Benefits of Using Reevo Money

1. Convenience

Users can manage finances from a smartphone or computer without visiting physical locations.

2. Accessibility

Digital systems reduce geographic limitations, making financial tools more widely available.

3. Efficiency

Automated processes minimize delays, manual errors, and repetitive tasks.

4. Modern Financial Control

With instant transaction records and digital insights, users gain better visibility into their spending and income patterns.

Potential Use Cases for Reevo Money

Personal Finance Management

Individuals can use Reevo Money to:

- Send and receive funds

- Track daily spending

- Manage digital balances

Freelancers and Remote Workers

For people working across borders or online platforms, Reevo Money offers a conceptual solution for faster, simpler payments.

Small and Online Businesses

Businesses benefit from:

- Streamlined payment collection

- Reduced administrative overhead

- Improved cash flow visibility

Digital Services and Subscriptions

Recurring payments and digital services align naturally with Reevo Money-style systems.

Security and Trust in Reevo Money

Security is often the deciding factor in whether users adopt a financial platform. Reevo Money places strong emphasis on:

- Data privacy – protecting personal and financial information

- System reliability – minimizing downtime and errors

- User education – encouraging responsible financial behavior

Trust is not built overnight, but transparent systems and consistent performance help establish long-term credibility.

Challenges and Considerations

While digital finance offers many advantages, it also comes with challenges:

Learning Curve

New users may need time to understand digital wallets and online money systems.

Technology Dependence

Reliable internet access and compatible devices are essential.

Regulatory Awareness

Digital money platforms must operate responsibly within legal frameworks, even as regulations evolve.

Reevo Money addresses these challenges through design simplicity, user guidance, and adaptable system architecture.

The Future Outlook of Reevo Money

4

Looking ahead, Reevo Money aligns with several powerful trends:

- Growth of digital-only financial services

- Increasing demand for real-time payments

- Expansion of global online commerce

- Greater focus on user-controlled finance

As technology matures, platforms inspired by Reevo Money are likely to become more intelligent, more personalized, and more deeply integrated into everyday life.

Why Reevo Money Matters

Reevo Money represents more than just a way to move funds—it symbolizes a shift in how people think about money. Instead of being tied to locations, hours, or paperwork, finance becomes:

- Mobile

- Instant

- Transparent

- User-driven

This shift empowers individuals and businesses to operate with greater confidence and flexibility.

Final Thoughts

Reevo Money stands as a modern vision of digital finance—one that prioritizes people, technology, and accessibility. In a world where financial interactions are increasingly digital, platforms inspired by Reevo Money help bridge the gap between traditional banking and the future of money.

By focusing on simplicity, security, and scalability, Reevo Money reflects the direction in which global finance is heading. Whether for personal use, business operations, or digital commerce, it highlights how money can become smarter, faster, and more aligned with modern lifestyles.