Investors searching for high-growth opportunities in the biotechnology sector often come across ESPR stock Forecast , the ticker symbol for Esperion Therapeutics. Known for its focus on cardiovascular treatments, Esperion has generated significant attention due to both its innovative drug pipeline and its volatile stock performance.

Overview of ESPR Stock

ESPR stock represents ownership in Esperion Therapeutics, a biotechnology company primarily focused on developing oral, non-statin therapies for lowering LDL cholesterol. The company’s mission targets a major unmet medical need: patients who cannot tolerate traditional statin treatments.

Because cardiovascular disease remains one of the leading causes of death globally, the market opportunity for effective cholesterol-lowering therapies is substantial. This alone positions ESPR stock as a speculative but potentially rewarding investment for long-term investors willing to tolerate risk.

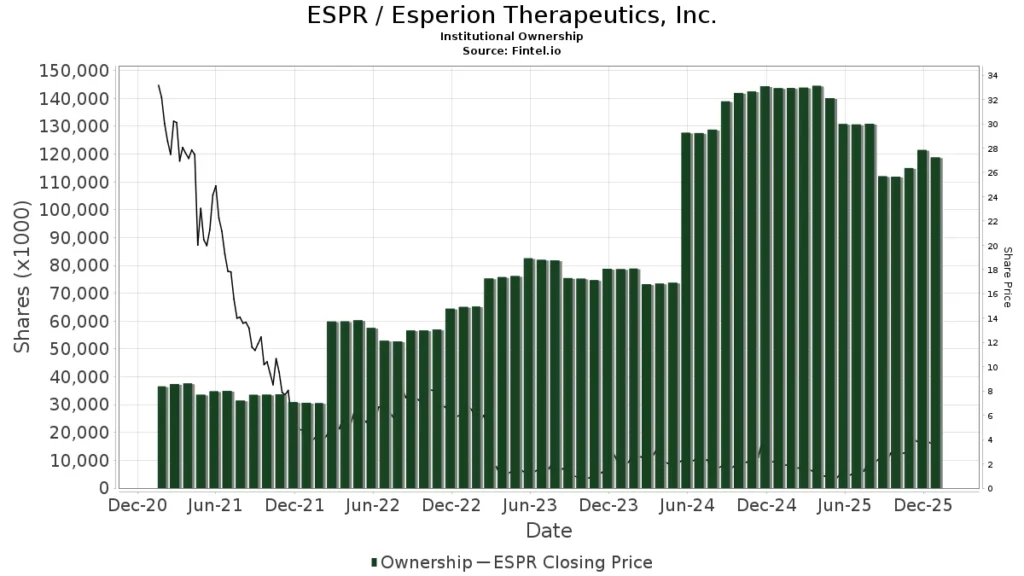

Historical Performance of ESPR Stock

The historical price action of ESPR stock reflects a classic biotech trajectory:

- Sharp rallies following positive clinical trial news

- Steep declines during funding concerns or regulatory uncertainty

- Extended consolidation phases when awaiting catalysts

Unlike established pharmaceutical giants, Esperion’s valuation has been highly sensitive to news, earnings reports, and strategic partnerships. This volatility has made ESPR stock popular among traders while also testing the patience of long-term holders.

From a technical perspective, ESPR has experienced repeated cycles of accumulation and distribution, suggesting that investor sentiment plays a major role in price movement.

Key Business Drivers Affecting ESPR Stock Forecast

1. Drug Commercialization Success

Esperion’s future revenue depends heavily on the commercial performance of its cholesterol-lowering drugs. Strong prescription growth, expanded insurance coverage, and international adoption are all essential to improving cash flow.

2. Market Competition

ESPR stock faces competition from both statin drugs and newer injectable therapies. The company’s ability to differentiate its oral medications on safety, convenience, and cost will heavily influence its long-term valuation.

3. Financial Health and Cash Burn

Like many biotech companies, Esperion has historically operated at a loss. Investors closely watch:

- Quarterly cash reserves

- Operating expenses

- Debt restructuring or refinancing efforts

Improved financial stability could significantly boost confidence in ESPR stock.

4. Strategic Partnerships and Licensing

Partnerships with larger pharmaceutical firms can provide:

- Non-dilutive funding

- Global distribution networks

- Increased credibility

Any new collaboration could act as a powerful bullish catalyst for ESPR stock.

Short-Term ESPR Stock Forecast

In the short term, ESPR stock is likely to remain volatile. Price movements may be influenced by:

- Earnings reports

- Prescription growth updates

- Management guidance

- Broader biotech sector sentiment

Short-term traders often focus on technical indicators such as moving averages, trading volume, and support/resistance zones. Sudden spikes or drops are not uncommon, making ESPR stock better suited for experienced traders rather than conservative investors in the near term.

Mid-Term ESPR Stock Outlook

Over the medium term, the ESPR stock forecast depends largely on execution. If Esperion can demonstrate:

- Consistent revenue growth

- Improved operating margins

- Reduced cash burn

then investor sentiment may gradually shift from speculative to cautiously optimistic. Mid-term investors often look for confirmation that the company can sustain operations without excessive dilution.

A stabilization phase in ESPR stock could precede a more sustained upward trend if fundamentals improve.

Long-Term ESPR Stock Forecast

From a long-term perspective, ESPR stock represents a high-risk, high-reward investment. The upside potential is tied to several long-term factors:

Expansion of Cardiovascular Treatment Demand

As global populations age, demand for cardiovascular therapies is expected to grow. Esperion’s focus on non-statin alternatives could capture a meaningful niche.

Pipeline Development

Additional indications, combination therapies, or next-generation compounds could significantly enhance the company’s valuation.

Path to Profitability

If Esperion eventually reaches profitability or becomes a takeover target, ESPR stock could experience substantial appreciation over time.

However, long-term investors must also account for the possibility of setbacks, including slower adoption rates or funding challenges.

Technical Analysis Perspective on ESPR Stock

From a technical standpoint, ESPR stock often trades in wide ranges, reflecting uncertainty and speculative interest. Common characteristics include:

- High volume during news events

- Strong reactions at psychological price levels

- Prolonged consolidation periods

Long-term trend reversals typically require confirmation through both price action and improving fundamentals.

й

Risk Factors to Consider

No ESPR stock forecast would be complete without addressing risks:

- Regulatory risks: Any changes in drug approval or labeling

- Financial risks: Potential dilution through equity offerings

- Market risks: Broader downturns in biotech or equity markets

- Execution risks: Slower-than-expected commercialization

Investors should never allocate capital to ESPR stock without understanding these uncertainties.

Is ESPR Stock a Good Investment?

Whether ESPR stock is a good investment depends on individual risk tolerance and investment horizon:

- Aggressive investors may view ESPR as a speculative growth opportunity

- Long-term biotech investors may appreciate its focused niche

- Conservative investors may find the volatility unsuitable

Diversification and position sizing are especially important when investing in smaller biotechnology companies like Esperion.

Final Thoughts on ESPR Stock Forecast

The ESPR stock forecast remains complex, driven by innovation, execution, and financial discipline. Esperion Therapeutics operates in a massive healthcare market with genuine unmet needs, but success is far from guaranteed.

For investors willing to embrace volatility and uncertainty, ESPR stock offers exposure to a potentially transformative cardiovascular therapy story. For others, it serves as a reminder that biotech investing requires patience, research, and disciplined risk management.

As with any stock forecast, outcomes will ultimately depend on factors that unfold over time—making ESPR stock a name worth watching closely in the evolving biotech landscape.