The Helix Exploration share price has become a growing topic of discussion among investors who are actively watching the natural resources and exploration sector. As global markets continue to prioritize energy security, critical raw materials, and diversification away from traditional hydrocarbons, exploration-focused companies are increasingly under the spotlight. Helix Exploration, operating within a niche segment of the energy market, represents a unique investment case that blends geological potential, early-stage risk, and long-term reward possibilities.

Understanding Helix Exploration as a Company

Helix Exploration operates within the exploration segment of the energy market, with a strategic focus on identifying and developing subsurface resources that are considered increasingly valuable in modern industrial applications. Unlike conventional oil and gas producers, exploration-stage companies often trade more on potential and progress than on existing revenue streams.

Because Helix Exploration is still in the development and exploration phase, its share price does not behave like that of mature dividend-paying energy firms. Instead, valuation is largely driven by:

- Geological surveys and exploration results

- Licensing and regulatory approvals

- Capital availability and funding rounds

- Broader commodity demand expectations

This makes the Helix Exploration share price particularly sensitive to news, announcements, and shifts in market sentiment.

Historical Behavior of the Helix Exploration Share Price

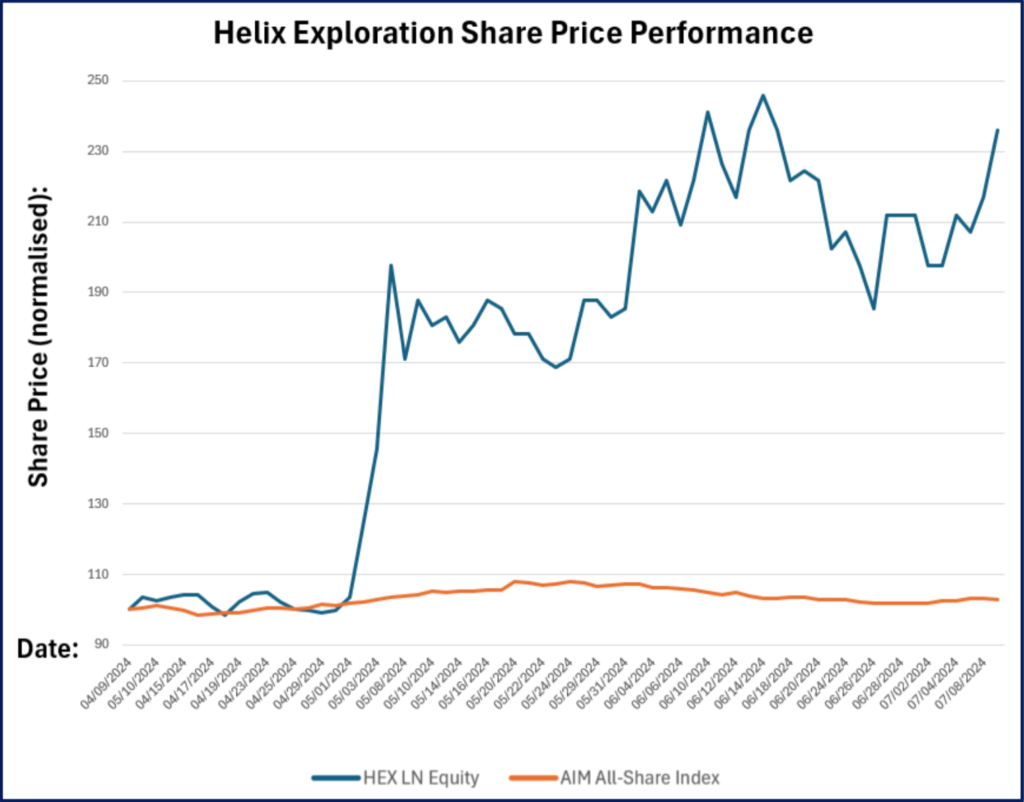

While past performance is never a guarantee of future results, understanding historical price behavior helps investors contextualize volatility. The Helix Exploration share price has typically exhibited characteristics common to early-stage exploration companies:

- High Volatility

Sharp upward and downward price movements are common, often triggered by project updates or financing news. - Event-Driven Rallies

Announcements related to exploration milestones or strategic developments can lead to rapid price appreciation. - Periods of Consolidation

Between major updates, the share price may trade sideways as investors wait for new information.

Such behavior reflects the speculative nature of exploration equities, where valuation is forward-looking rather than revenue-based.

Key Factors Influencing the Helix Exploration Share Price

1. Exploration Progress and Technical Results

The most direct influence on the Helix Exploration share price is progress on exploration activities. Positive geological indicators, successful drilling outcomes, or confirmation of commercially viable resources can significantly increase investor confidence.

Conversely, delays, inconclusive results, or higher-than-expected costs can place downward pressure on the share price.

2. Commodity Demand and Market Trends

Helix Exploration operates within a market influenced by long-term global demand trends. Certain industrial gases and subsurface resources are becoming increasingly important due to their role in:

- Semiconductor manufacturing

- Medical technology

- Scientific research

- Clean energy infrastructure

When market sentiment turns bullish on these sectors, exploration companies positioned within them often experience increased investor interest, which can positively affect share prices.

3. Funding and Capital Structure

Exploration companies typically require ongoing capital to fund operations. The Helix Exploration share price can be affected by:

- Equity placements

- Share dilution

- Strategic investments or partnerships

While capital raises are necessary for growth, frequent dilution may concern existing shareholders and temporarily suppress share price performance.

4. Broader Market Conditions

Macroeconomic factors also play a role. Interest rates, inflation expectations, and overall equity market sentiment influence risk appetite. During risk-on environments, speculative exploration stocks tend to perform better. In contrast, risk-off conditions may drive investors toward safer assets, pressuring smaller exploration equities.

Investor Sentiment and Market Psychology

The Helix Exploration share price is strongly influenced by investor psychology. Unlike large-cap stocks that rely heavily on earnings reports, exploration companies are driven by expectations and narrative.

Key sentiment drivers include:

- Confidence in management expertise

- Transparency in communication

- Credibility of technical reports

- Long-term vision for commercialization

Retail investors, in particular, may react quickly to news headlines, creating short-term volatility that does not always reflect fundamental value.

Risk Factors Associated with Helix Exploration Shares

Investing in Helix Exploration carries a range of risks that investors must consider carefully.

Exploration Risk

There is no guarantee that exploration activities will result in commercially viable discoveries. Geological uncertainty remains one of the biggest risks.

Regulatory and Licensing Risk

Exploration projects are subject to environmental regulations, permitting requirements, and government oversight. Any changes in regulatory frameworks can delay or disrupt progress.

Financial Risk

As a pre-revenue or early-stage company, Helix Exploration may rely heavily on external funding. Market conditions that limit access to capital can negatively affect operations and share price performance.

Liquidity Risk

Smaller exploration stocks often experience lower trading volumes, which can amplify price swings and make entry or exit more challenging for investors.

Growth Opportunities and Upside Potential

Despite the risks, the Helix Exploration share price also reflects meaningful upside potential.

Strategic Positioning

Operating in a niche segment of the energy and resources market gives Helix Exploration exposure to long-term structural demand rather than purely cyclical trends.

Technological Advancements

Advances in exploration technology, data analysis, and drilling efficiency can improve success rates and reduce costs, enhancing overall project economics.

Commercialization Pathways

Should Helix Exploration successfully move from exploration to development and production, the company’s valuation profile could shift dramatically, potentially leading to a re-rating of its share price.

Long-Term Outlook for the Helix Exploration Share Price

The long-term outlook for the Helix Exploration share price depends on the company’s ability to execute its strategy effectively. Key determinants include:

- Continued progress on exploration milestones

- Strong capital management and funding discipline

- Favorable market conditions for critical resources

- Clear communication with investors

For long-term investors, Helix Exploration represents a high-risk, high-reward opportunity. The share price is unlikely to move in a straight line, but sustained operational success could unlock significant value over time.

Is Helix Exploration Suitable for All Investors?

Helix Exploration shares may not be suitable for conservative investors seeking stable income or low volatility. However, they may appeal to:

- Growth-oriented investors

- Speculative investors comfortable with risk

- Portfolio diversifiers seeking exposure to exploration assets

A balanced investment approach often involves limiting exposure to early-stage exploration stocks while maintaining diversification across sectors.

Final Thoughts on Helix Exploration Share Price

The Helix Exploration share price reflects the complex intersection of geology, market sentiment, capital markets, and long-term resource demand. While short-term price movements can be unpredictable, the underlying investment case is driven by exploration success and strategic execution.

Investors considering Helix Exploration should focus less on daily price fluctuations and more on the company’s progress toward tangible milestones. With patience, disciplined risk management, and a long-term perspective, Helix Exploration can represent an intriguing opportunity within the broader energy and resources investment landscape.