In today’s fast-moving real estate landscape, property managers and letting agents face increasing pressure to operate efficiently, remain compliant, and deliver a seamless experience to landlords and tenants alike. Manual processes, spreadsheets, and disconnected systems are no longer enough. This is where PayProp stands out as a modern, cloud-based solution designed specifically for property management accounting and automated payments.

This in-depth article explores PayProp in detail—what it is, how it works, its core features, benefits, and why it has become an essential tool for property professionals seeking accuracy, transparency, and scalability.

What Is PayProp?

PayProp is a cloud-based property management and payment automation platform built for letting agents and property managers. Its primary purpose is to simplify complex financial workflows by automating rent collection, payment distribution, and reporting—all within a secure and compliant system.

Unlike generic accounting tools, PayProp is designed specifically for the property industry. It connects landlords, tenants, and agents through a single platform, reducing manual data entry and minimizing the risk of errors. By automating repetitive financial tasks, PayProp allows property professionals to focus more on growth, customer service, and portfolio expansion.

Why Property Managers Need Specialized Software

Property management is financially complex. Each property may have different rent amounts, payment schedules, fees, and compliance requirements. Traditional accounting systems often struggle to handle these nuances without heavy customization.

PayProp addresses these challenges by offering:

- Automated rent processing

- Real-time financial visibility

- Built-in compliance features

- Scalable infrastructure for growing portfolios

For agencies managing dozens—or even thousands—of properties, this specialization can make a measurable difference in efficiency and profitability.

Core Features of PayProp

1. Automated Rent Collection

One of PayProp’s strongest features is its automated rent collection system. Once rent is received, the platform automatically allocates funds according to predefined rules. This includes management fees, maintenance costs, and landlord payouts.

Automation removes the need for manual reconciliation and significantly reduces delays and human error.

2. Fast and Accurate Payment Distribution

PayProp ensures that landlords, contractors, and other stakeholders are paid accurately and on time. Payments are processed securely, with clear audit trails that show exactly where money comes from and where it goes.

This level of transparency builds trust and reduces disputes.

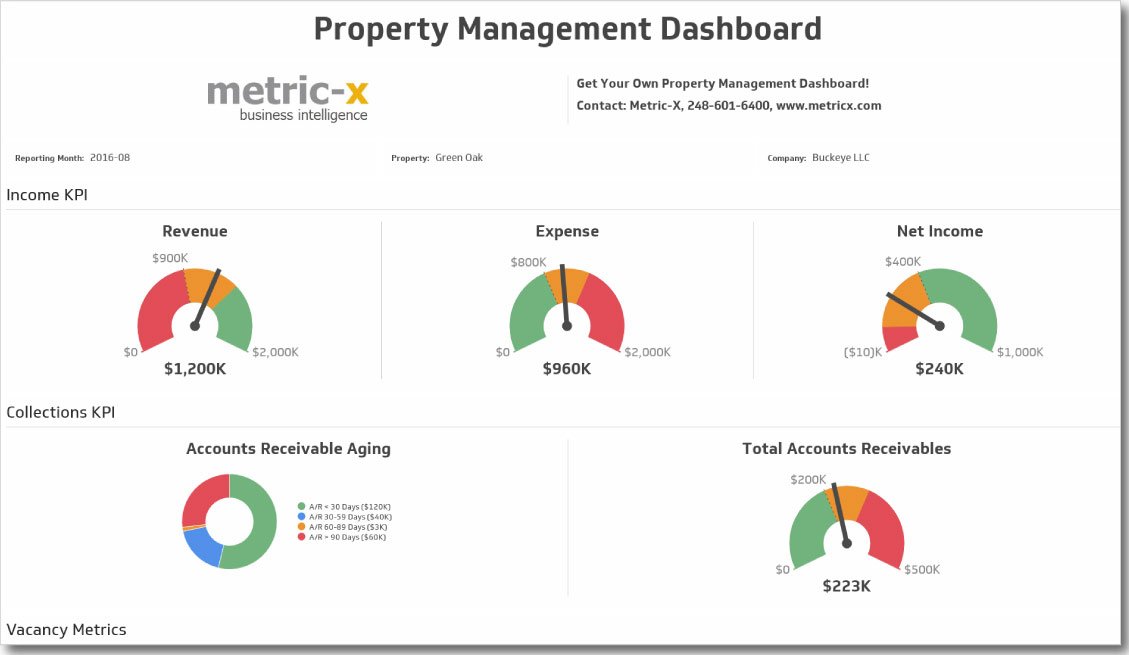

3. Real-Time Financial Reporting

Property managers can access real-time financial data at any moment. Reports are automatically generated and easy to understand, covering areas such as:

- Income and expenses

- Landlord statements

- Agency commission

- Portfolio performance

These insights help agencies make informed business decisions without waiting for end-of-month reconciliations.

PayProp Portals: One Platform, Multiple Users

Landlord Portal

Landlords gain access to a dedicated online portal where they can:

- View income and expenses in real time

- Download statements

- Track payment history

- Monitor portfolio performance

This transparency reduces unnecessary communication and enhances landlord satisfaction.

Tenant Portal

Tenants can also benefit from PayProp through features that allow them to:

- View rent payment history

- Access important financial documents

- Enjoy a clearer, more professional payment experience

By improving the tenant journey, property managers can increase retention and reduce late payments.

Security and Compliance at the Core

Handling financial data requires robust security and strict compliance. PayProp is built with these priorities in mind.

Key security and compliance elements include:

- Secure cloud infrastructure

- Encrypted data transmission

- Clear audit trails for all transactions

- Support for regulatory requirements in property accounting

These features help agencies meet legal obligations while protecting sensitive client information.

How PayProp Improves Business Efficiency

Reducing Manual Work

Manual data entry is time-consuming and prone to error. PayProp eliminates repetitive tasks by automating:

- Rent allocation

- Fee deductions

- Payment scheduling

- Statement generation

This can save agencies countless hours each month.

Minimizing Errors and Disputes

Because transactions are automated and traceable, errors are significantly reduced. When questions arise, agents can quickly reference detailed transaction histories, preventing misunderstandings with landlords or tenants.

Scaling Without Stress

As property portfolios grow, financial complexity increases. PayProp is designed to scale effortlessly, allowing agencies to manage more properties without increasing administrative overhead.

PayProp for Growing Letting Agencies

For small agencies, PayProp provides structure and professionalism from day one. For larger firms, it offers the reliability and performance required to manage complex portfolios.

Benefits for growing agencies include:

- Consistent financial processes

- Improved cash flow management

- Enhanced brand reputation

- Better client retention

By streamlining back-office operations, agencies can focus on winning new business and delivering exceptional service.

Integration With Property Management Systems

PayProp is designed to integrate with other property management tools and platforms. This connectivity ensures a smooth flow of data between systems, reducing duplication and improving accuracy.

Integrated systems mean:

- Faster onboarding of new properties

- Centralized data management

- Better overall operational efficiency

Transparency as a Competitive Advantage

In an industry where trust is critical, transparency can set an agency apart. PayProp’s real-time reporting and open access to financial data give landlords confidence that their investments are being managed responsibly.

This transparency:

- Strengthens long-term relationships

- Reduces complaints

- Supports positive referrals and reviews

The Future of Property Management With PayProp

The property industry is moving toward automation, data-driven decisions, and digital experiences. PayProp aligns perfectly with these trends by offering a future-ready platform that evolves with the needs of property professionals.

As regulations become stricter and client expectations rise, solutions like PayProp are no longer optional—they are essential.

Final Thoughts: Is PayProp Worth It?

PayProp is more than just payment software. It is a comprehensive property management accounting solution that empowers agencies to operate smarter, faster, and with greater confidence.

By automating rent collection, ensuring accurate payments, and delivering real-time financial insights, PayProp helps property managers reduce stress, improve client satisfaction, and scale their businesses sustainably.