The foreign exchange market, commonly known as Forex, is the largest and most liquid financial market in the world. Every day, trillions of dollars’ worth of currencies are exchanged by banks, institutions, governments, corporations, and individual traders. With such massive activity, opportunities exist almost around the clock. However, the same market that offers opportunity also carries significant risk, especially for traders who lack experience, time, or advanced analytical skills.

This is where Forex signals come into play. Forex signals are designed to guide traders by providing actionable trading ideas based on market analysis. For many, they act as a bridge between complex market data and practical trading decisions. This article explores Forex signals in detail—what they are, how they work, their types, benefits, limitations, and how traders can use them responsibly to improve consistency and discipline.

What Is a Forex Signal?

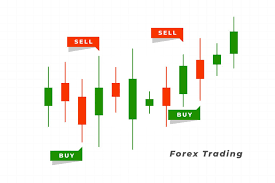

A Forex signal is a trading suggestion or alert that indicates a potential opportunity in the currency market. It usually includes specific information such as:

- The currency pair (for example, EUR/USD or GBP/JPY)

- The direction of the trade (buy or sell)

- The entry price or range

- Stop-loss level (to limit risk)

- Take-profit target(s)

Forex signals are created using different forms of market analysis. Some rely heavily on technical indicators, others on fundamental economic data, while many combine both. Signals can be generated manually by professional analysts or automatically by trading algorithms.

At their core, Forex signals aim to answer one key question for traders: when and where to trade.

Why Forex Signals Exist

Forex trading requires constant attention, fast decision-making, and the ability to interpret charts, indicators, and economic news. Not everyone has the time or expertise to do this effectively. Forex signals exist to fill that gap.

They help traders by:

- Reducing analysis time

- Providing structure and clarity

- Supporting decision-making with data

- Offering learning opportunities for beginners

While signals do not eliminate risk, they can reduce uncertainty when used correctly.

Types of Forex Signals

Forex signals are not all the same. They differ based on how they are generated, delivered, and used.

1. Manual Forex Signals

Manual signals are created by experienced traders or analysts who study the market themselves. They analyze price charts, economic news, and market sentiment before sending out a trade idea.

Advantages:

- Human judgment and experience

- Flexibility during unusual market conditions

- Often include explanations and reasoning

Disadvantages:

- Slower than automated systems

- Quality depends entirely on the analyst’s skill

2. Automated Forex Signals

Automated signals are generated by software, algorithms, or trading robots. These systems follow predefined rules based on technical indicators and price behavior.

Advantages:

- Fast and emotionless execution

- Can monitor multiple markets at once

- Consistent rule-based logic

Disadvantages:

- Limited adaptability

- Can fail during high volatility or unexpected news

3. Free vs Paid Forex Signals

Free Forex Signals

These are often offered by brokers or communities. While some are useful, others may lack accuracy or proper risk management.

Paid Forex Signals

Paid services usually claim higher accuracy, better analysis, and customer support. However, higher cost does not always guarantee better performance.

The key is not whether signals are free or paid, but whether they are transparent, consistent, and realistic.

How Forex Signals Are Created

Forex signals are typically based on one or more of the following approaches:

Technical Analysis

This involves studying price charts and indicators such as:

- Moving averages

- RSI (Relative Strength Index)

- MACD

- Support and resistance levels

- Chart patterns

Technical analysis assumes that price behavior repeats over time and that historical data can suggest future movement.

Fundamental Analysis

Fundamental analysis focuses on economic and political factors, including:

- Interest rate decisions

- Inflation reports

- Employment data

- Central bank statements

- Geopolitical events

Signals based on fundamentals often target larger price moves and longer timeframes.

Sentiment Analysis

This approach studies the overall mood of the market—whether traders are mostly bullish or bearish. Sentiment indicators and positioning data help identify overcrowded trades or potential reversals.

How Traders Receive Forex Signals

Forex signals can be delivered through various channels, depending on the provider:

- Messaging apps (such as private groups)

- Email alerts

- Mobile apps

- Trading platforms

- Web dashboards

The most effective delivery methods are fast, clear, and easy to follow. Delays or vague instructions can reduce a signal’s usefulness.

Benefits of Using Forex Signals

Forex signals offer several potential benefits when used responsibly.

1. Time Efficiency

Signals save traders from spending hours analyzing charts and news. This is especially helpful for part-time traders.

2. Learning Tool

By following signals and reviewing outcomes, traders can learn how professionals analyze the market and manage risk.

3. Reduced Emotional Trading

Signals can reduce impulsive decisions driven by fear or greed by providing predefined entry and exit points.

4. Structure and Discipline

Having clear rules for entering and exiting trades promotes consistency, which is crucial in long-term trading success.

The Risks and Limitations of Forex Signals

Despite their advantages, Forex signals are not a guaranteed path to profit.

1. No Signal Is 100% Accurate

Losses are part of trading. Even the best signal providers experience losing trades.

2. Over-Reliance

Blindly following signals without understanding them can prevent traders from developing their own skills.

3. Market Conditions Change

A signal strategy that works well in one market environment may fail in another.

4. Scams and False Promises

Some providers exaggerate results, hide losses, or manipulate performance data. Unrealistic profit claims are a major warning sign.

Risk Management and Forex Signals

Risk management is more important than the signal itself. A good signal always includes a stop-loss and realistic take-profit targets.

Traders should also:

- Risk only a small percentage of their account per trade

- Avoid overtrading

- Keep a trading journal

- Understand the logic behind each signal

Without proper risk control, even accurate signals can lead to account losses.

Who Should Use Forex Signals?

Forex signals can benefit different types of traders:

- Beginners: Learn market behavior and gain confidence

- Busy traders: Participate in the market without constant monitoring

- Intermediate traders: Compare signals with personal analysis

- Advanced traders: Use signals as confirmation, not instruction

However, signals should always be viewed as support tools, not replacements for knowledge.

Choosing a Reliable Forex Signal Provider

When evaluating a Forex signal provider, consider the following factors:

- Transparency of past results

- Clear risk management rules

- Realistic performance claims

- Consistent communication

- Educational value

A reliable provider focuses on long-term consistency rather than short-term hype.

Building Independence While Using Signals

The ultimate goal for many traders is independence. Forex signals can be part of that journey rather than the destination.

Traders can:

- Analyze why a signal was given

- Compare multiple signals

- Back-test similar setups

- Gradually rely more on personal analysis

Over time, this approach builds confidence and skill.

The Future of Forex Signals

As technology evolves, Forex signals continue to change. Artificial intelligence, machine learning, and advanced data analysis are playing a growing role in signal generation. At the same time, the human element—experience, intuition, and judgment—remains valuable.

The most effective future solutions will likely combine automation with human oversight.

Conclusion

Forex signals are powerful tools when used with understanding, discipline, and realistic expectations. They can save time, reduce emotional trading, and provide valuable learning opportunities. However, they are not shortcuts to guaranteed profits.